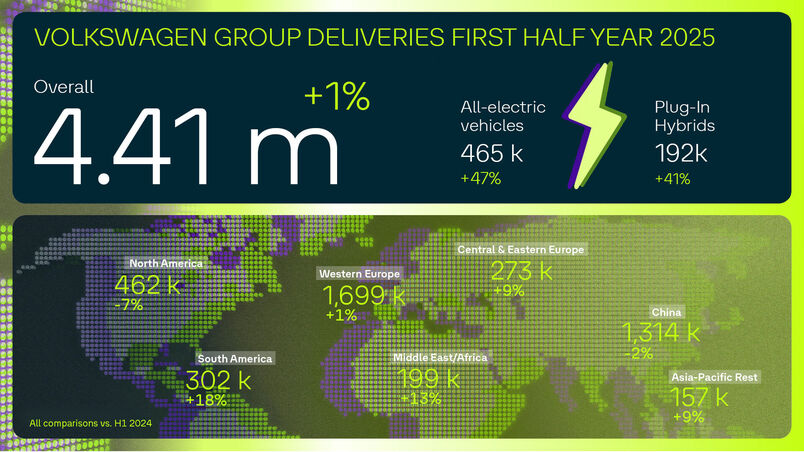

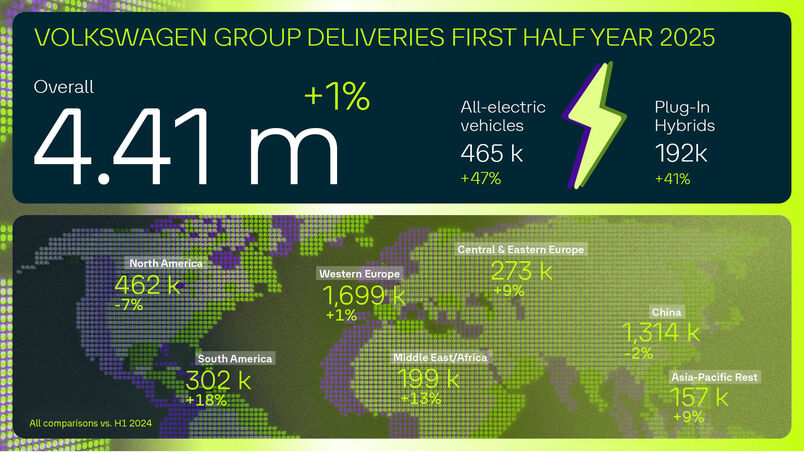

“The Volkswagen Group continues to have strong momentum thanks to many newly launched models. This applies especially to all-electric vehicles, with global deliveries up by around 50 per cent in the first half of the year compared to the same period last year. This trend was particularly strong in Europe, with growth of around 90 per cent. One in five of the vehicles we delivered in Western Europe is now purely electric. The corresponding orders are also developing dynamically: they increased by more than 60 per cent. Across all drive types, they went up by around 20 per cent. We need to further strengthen this positive development by continuing our successful model offensive. Overall, we were able to slightly increase our global deliveries by the end of June despite challenging conditions. Gains in South America and Europe more than offset the expected declines in China and North America.”

Marco Schubert, Member of the Group’s Extended Executive Committee for Sales

Key figures

| 4.41 million vehicles delivered worldwide after first half of the year, up 1.3 per cent on previous year (4.35 million vehicles) | Growth in South America (+18 per cent), Western Europe (+1 per cent) and Central and Eastern Europe (+9 per cent) more than compensates for expected declines in China (-2 per cent) and North America (-7 per cent) | |

| 465,500 BEV deliveries worldwide by the end of June up 47 per cent on previous year (317,200 vehicles) | Global BEV share in the first half of the year increases significantly year-on-year from 7 to 11 per cent, strong growth in Europe (+89 per cent) and the USA (+24 per cent), declining development in China (-34 per cent), Volkswagen Group clear BEV market leader in Europe (market share of around 28 per cent) | |

| Incoming orders in Western Europe increase by 19 per cent in the first six months | Rising orders are driven by new models popular with customers across all drive types, such as the VW ID.7 Tourer, CUPRA Terramar, Škoda Elroq, Audi Q6 e-tron and Porsche 911, BEV orders increase most significantly (+62 per cent) | |

| 192,300 PHEV deliveries worldwide are around 41 per cent higher than in the same period last year (136,800 vehicles) | Demand for vehicles with modern second-generation plug-in hybrid drives (PHEV) and all-electric ranges of up to 143 km1 is increasing | |

Development of core regions

| Europe A total of 1,971,600 vehicles were delivered in the region, an increase of 2.0 per cent.In Western Europe, growth amounted to 1.0 per cent, in Central and Eastern Europe to 8.5 per cent. In the home market of Germany, 1.9 per cent more vehicles were handed over to customers. | North America 461,900 customers took delivery of a Group brand vehicle, 6.7 per cent fewer than in the same period last year. In the USA, the main market, the decline amounted to 8.5 per cent in a challenging environment. In the first quarter, the Volkswagen Group had still grown by 6.2 per cent there. | |

| South America The region recorded the strongest growth of 18.3 per cent to 302,100 vehicles. In Brazil, the main market, growth amounted to 7.4 per cent. | Asia-Pacific The region recorded a decline of 1.3 per cent to 1,470,900 vehicles, mainly due to the intense competitive situation in China. At 2.3 per cent, the decline in deliveries there was in line with expectations. | |

Best-selling all-electric vehicles (BEV)

Volkswagen ID.4/ID.5 84,900

Volkswagen ID.3 60,700

Audi Q4 e-tron (incl. Sportback) 44,600

Volkswagen ID.7 (incl. Tourer) 38,700

Škoda Enyaq (incl. Coupé) 38,700

Audi Q6 e-tron (incl. Sportback) 36,500

Škoda Elroq 34,300

Volkswagen ID. Buzz (incl. Cargo) 27,600

Porsche Macan 25,900

CUPRA Born 22,100

1) Volkswagen Golf 1.5 eHybrid: energy consumption weighted combined 15.6-14.6 kWh/100 km plus 0.3 l/100 km; fuel consumption with discharged battery combined: 5.3-5.0 l/100 km; CO2 emissions weighted combined 7-6 g/km; CO2 class weighted combined: B; CO2 class with discharged battery: D-C

Audi A3 Sportback TFSI E: Energy consumption weighted combined 16.6-14.6 kWh/100 km plus 0.4-0.3 l/100 km; fuel consumption with discharged battery combined: 5.4-4.9 l/100 km; CO2 emissions weighted combined 8-6 g/km; CO2 class weighted combined: B; CO2 class with discharged battery: D-C

Deliveries Volkswagen Group – All drive types

| Deliveries to customers by market | Apr. – Jun. 2025 | Apr. – Jun. 2024 | Delta (%) | Jan. – Jun. 2025 | Jan. – Jun. 2024 | Delta (%) | |

| Western Europe | 884,500 | 891,000 | -0.7 | 1,698,500 | 1,681,000 | +1.0 | |

| Central and Eastern Europe | 147,300 | 135,000 | +9.1 | 273,100 | 251,600 | +8.5 | |

| North America | 224,700 | 268,100 | -16.2 | 461,900 | 495,200 | -6.7 | |

| South America | 163,900 | 136,800 | +19.8 | 302,100 | 255,300 | +18.3 | |

| China | 669,700 | 651,500 | +2.8 | 1,313,800 | 1,345,100 | -2.3 | |

| Rest of Asia-Pacific | 80,800 | 73,300 | +10.3 | 157,200 | 144,500 | +8.8 | |

| Middle East/Africa | 100,800 | 88,100 | +14.4 | 198,800 | 175,400 | +13.4 | |

| World | 2,271,700 | 2,243,900 | +1.2 | 4,405,300 | 4,348,100 | +1.3 | |

| Deliveries to customers by brand | Apr. – Jun. 2025 | Apr. – Jun. 2024 | Delta (%) | Jan. – Jun. 2025 | Jan. – Jun. 2024 | Delta (%) | |

| Brand Group Core | 1,711,400 | 1,644,600 | +4.1 | 3,311,700 | 3,188,000 | +3.9 | |

| Volkswagen Passenger Cars | 1,186,100 | 1,140,800 | +4.0 | 2,320,300 | 2,220,300 | +4.5 | |

| Škoda | 270,800 | 228,100 | +18.7 | 509,400 | 448,600 | +13.6 | |

| SEAT/CUPRA | 155,900 | 158,900 | -1.9 | 302,600 | 297,400 | +1.7 | |

| Volkswagen Commercial Vehicles | 98,700 | 116,900 | -15.6 | 179,500 | 221,700 | -19.0 | |

| Brand Group Progressive | 405,300 | 441,900 | -8.3 | 794,100 | 844,000 | -5.9 | |

| Audi | 400,100 | 436,000 | -8.2 | 783,500 | 833,000 | -5.9 | |

| Bentley | 2,500 | 3,000 | -16.2 | 4,900 | 5,500 | -11.0 | |

| Lamborghini | 2,700 | 2,900 | -7.3 | 5,700 | 5,600 | +2.2 | |

| Brand Group Sport Luxury | 74,900 | 78,300 | -4.3 | 146,400 | 155,900 | -6.1 | |

| Porsche | 74,900 | 78,300 | -4.3 | 146,400 | 155,900 | -6.1 | |

| Brand Group Trucks / TRATON | 80,100 | 79,000 | +1.4 | 153,200 | 160,100 | -4.3 | |

| MAN | 26,400 | 25,200 | +4.7 | 47,000 | 49,200 | -4.3 | |

| Volkswagen Truck & Bus | 11,400 | 11,900 | -4.1 | 24,800 | 23,400 | +5.9 | |

| Scania | 24,700 | 25,800 | -4.5 | 46,800 | 52,300 | -10.4 | |

| International | 17,600 | 16,000 | +9.9 | 34,500 | 35,300 | -2.3 | |

| Volkswagen Group (total) | 2,271,700 | 2,243,900 | +1.2 | 4,405,300 | 4,348,100 | +1.3 | |

Deliveries Volkswagen Group – All-electric vehicles (BEV)

| Deliveries to customers by market | Apr. – Jun. 2025 | Apr. – Jun. 2024 | Delta (%) | Jan. – Jun. 2025 | Jan. – Jun. 2024 | Delta (%) | |

| Europe | 189,700 | 109,700 | +72.9 | 347,900 | 184,100 | +89.0 | |

| USA | 11,400 | 12,000 | -5.2 | 31,300 | 25,200 | +24.3 | |

| China | 33,400 | 49,600 | -32.6 | 59,400 | 90,600 | -34.5 | |

| Rest of the world | 14,200 | 9,500 | +49.3 | 27,000 | 17,300 | +55.8 | |

| World | 248,700 | 180,800 | +37.6 | 465,500 | 317,200 | +46.7 | |

| Deliveries to customers by brand | Apr. – Jun. 2025 | Apr. – Jun. 2024 | Delta (%) | Jan. – Jun. 2025 | Jan. – Jun. 2024 | Delta (%) | |

| Brand Group Core | 177,200 | 134,800 | +31.5 | 328,700 | 230,900 | +42.3 | |

| Volkswagen Passenger Cars | 97,500 | 100,300 | -2.8 | 192,600 | 168,500 | +14.3 | |

| Škoda | 46,000 | 15,500 | +196.8 | 73,000 | 29,400 | +147.8 | |

| SEAT/CUPRA | 19,000 | 11,300 | +67.2 | 37,600 | 18,300 | +105.3 | |

| Volkswagen Commercial Vehicles | 14,800 | 7,600 | +94.2 | 25,500 | 14,700 | +73.4 | |

| Brand Group Progressive | 55,000 | 41,000 | +34.1 | 101,400 | 76,700 | +32.3 | |

| Audi | 55,000 | 41,000 | +34.1 | 101,400 | 76,700 | +32.3 | |

| Bentley | – | – | – | – | – | – | |

| Lamborghini | – | – | – | – | – | – | |

| Brand Group Sport Luxury | 15,800 | 4,700 | +235.6 | 34,200 | 9,000 | +279.0 | |

| Porsche | 15,800 | 4,700 | +235.6 | 34,200 | 9,000 | +279.0 | |

| Brand Group Trucks / TRATON | 700 | 300 | +124.1 | 1,300 | 600 | +108.8 | |

| MAN | 440 | 100 | +330.4 | 810 | 240 | +243.5 | |

| Volkswagen Truck & Bus | 0 | 10 | -87.5 | 50 | 80 | -44.0 | |

| Scania | 120 | 60 | +88.7 | 220 | 110 | +102.8 | |

| International | 90 | 120 | -21.2 | 180 | 170 | +2.9 | |

| Volkswagen Group (total) | 248,700 | 180,800 | +37.6 | 465,500 | 317,200 | +46.7 |