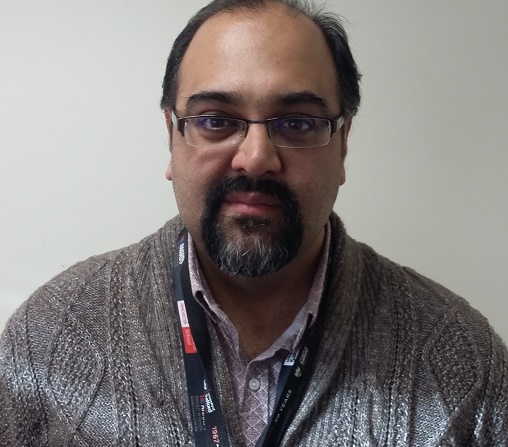

Faisal Sheikh, Lecturer in Accounting and Finance at the University of Salford Business School, reacts to the Budget, announced by Chancellor Rishi Sunak last week.

Faisal said: “I predict that from a policy perspective Monetarism will remain on the backburner and Keynesian economic policy (high spending underpinned by burgeoning taxes) will remain ‘King’ for at least a generation. The question is whether the British public can stomach tax rises which are currently funding the continued spending spree?

“The most eye-catching announcements are an extra £4.7bn for children’s education, an extra £2bn for further education and significant cut in Air Passenger Duty which be welcomed by the battered travel and tourism industry. There is also Christmas cheer with a cancellation of a planned rise in the duty on spirits, wine, cider and beer.

“Personally I find the cut to Air Passenger Duty problematic given that we are experiencing irreversible climate change and scientific experts are warning of mass environmental upheaval such as desertification and acute water shortages.”

And Zeeshan Syed, also of the University of Salford Business School, said: “Let’s get drunk, let’s travel more, and let’s spend more”, the message couldn’t be louder. The UK is officially in recovery phase as per treasury plan. With all the advertisement and stress on building back better, this budget imagines only one solution that is to import more and pay more duty on it.

“The budget presented is neither enough nor ambitious to achieve what Britons wanted in post-covid world. More money to train our young and increase connectivity is welcome, but this does not go far enough. The raise in minimum wage does not reflect the rise in living costs, inflation, and expected cost of personal debt in coming months.

“Once again, the “grey hair” bias has won, and youth of the country has lost. Dividend and capital gains are not taxed, property speculation is not taxed, expensive cars and high-end dining is subsidised.

“It is understandable that Rishi wanted to support our biggest employer the hospitality industry and largest tax contributor financial industry. But he ignores the needs to avoid perpetual shortages of labour and skilled labour to fill our shelves, build our houses, and maintain our infrastructure. He needed to subsidise the heavy industry, increase minimum salary for skilled labour and encouraged the manufacturing.

“Had Rishi done so, he could have entered in the league of Margaret Thatcher and Gordon Brown. He could have fundamentally shifted the nature, orientation, and direction of British Economy. His budget is directly opposite to everything promised to us in 2016 referendum. But hey! the good news is let’s get drunk and don’t forget to eat more meat, provided if we can deliver the Beer to Pubs and Butcher animals locally.”